Rethinking Media and Capitalism (1)

I’m a media researcher with rough but down-to-earth knowledge about capital market. I try to provide a less critical and more analytical perspective on the research we‘ve made and read.

First of all, we can barely map out the capitalism without understanding the job market. I differentiate three common career paths:

First, spokespersons from political sciences, economics or general social sciences may go for public sectors if they are dedicated to benefiting the society. But for higher rate of reward for their labor (salary per unit of working load), they also choose to conduct business consultancy or management.

Second, caregivers from biological sciences could take efforts on being medical practitioners. But similarly, for higher rate of reward, they are also visible in the beauty, medicine and healthcare industry.

Third, technicians from design&engineering faculty can contribute to the infrastructure construction. But obviously they‘ve been attracted to the software engineering and product design in current times.

As the employees exchange their skills for money, they desire for higher rate of reward for their labor. And when exploring their each career path, the information that capital market showcases is quite helpful for job seekers——higher capital an employer has, more reliable an employer seems to guarantee employees' welfare.

Having that job market's image in mind, we take a “reverse shot” to the employers——where does the capital come from? Basically, the income of a commercial entity consists of two parts:

large installments of investment from fund, shareholders, government or other enterprises

small installments of investment from individual customers

For example, the income of educational institutions could be the tuition; the income of banks is mostly the savings; the income of municipality is probably the tax. “Capital” shows an employer’s potential of profit-making, that is, higher income versus lower cost (the cost of a commercial entity includes: buying raw materials, buying the services, manufacturing, paying for the labor, building up the workplace, etc.)

"Capital” also shows how much the whole society, from fund to individuals, trust an employer. If investors (including individual customers) believe a certain employer can bring them values, regardless of commercial value, public value or emotional value, they pay, and then the employer's capital increases. It sounds like a fair trade-off —— A buys the values that (they believe) B creates; in exchange, A contribute to the B's capital.

This so-called “fairness” is how the capitalism works.

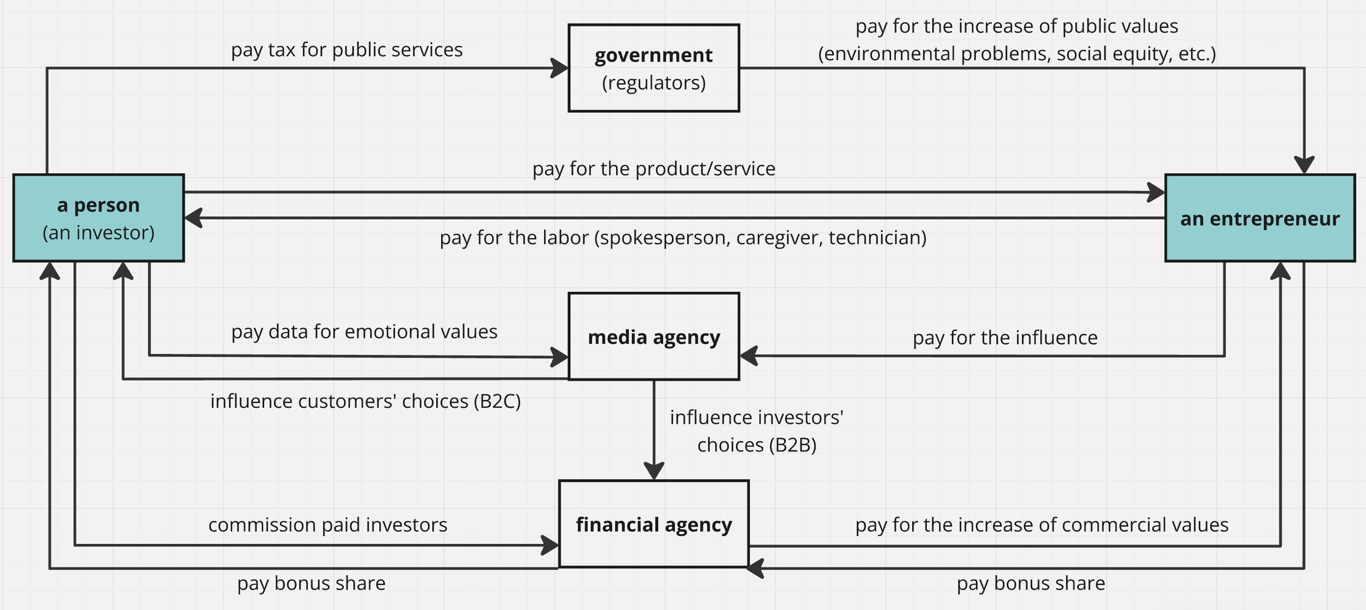

Based on that, I draw a diagram on the social relations of production nowadays:

In the past, we had more direct relationship between a person and an entrepreneur. But now there are a lot more players in between, such as the financial agencies, media and regulators. With them, a person now has 3 ways to contribute to an entrepreneur's capital:

be the customer: buy the product or service

be the shareholder: invest through the financial agency (incl. bank savings)

be the taxpayer: trust an entrepreneur for doing social good (via. government)

And media here influences which entrepreneur a person wants to be the customer of, the shareholder of and the taxpayer of. In other words, media modifies the capital flow, and personally I think that's how the society nowadays is distinct from the past times.

In return, an entrepreneur also has 3 ways to reward a person:

distribute the salary to the labor

distribute the bonus share to the investor

contribute to the public welfare

On this diagram we can also analyze some urgent issues:

The biggest risk of AI is that AI potentially lowers the cost that an employer should pay for the labor. For technicians, AI could provide more "satisfying" codes or design since AI is strictly goal-oriented. For caregivers and spokespersons, AI could do more efficient data analysis of the clients as the database grows. As for highly repetitive labour, AI training probably leads to lower management cost than human resources management. All in all, worries make sense that employers choose to hire less human.

AI lowers the cost, and meanwhile, the label “trendy technology” makes it competitive on the capital market and attracts more investment. For a short period of time, AI boosts an entrepreneur's profit-making as the result of the lower cost versus higher income. Accordingly, individuals may become poor. The unemployment it causes usually leads to higher crime rate and potential consumption decline, which actually does not benefit any industry.

Energy transition is another big issue. A company could lower the commercial costs at the expense of environmental cost; for example, water or air pollution of the factory or facilitators, as well as cheaper unrenewable raw materials (e.g., fossil fuel). But energy transition seems more optimistic because renewable energy is another "trendy technology" label on the capital market. Investments are now going to the energy transition initiatives in all industries.

But how effective those initiatives are? In fact it is really hard to evaluate. Or do the evaluation or regulation agencies for those initiatives create more jobs? The answer is fairly yes if we still keep optimistic.

In most times, capitalism is a self-contained system that exploits individual wealth but also automatically adjusts the wealth gap. The reason is very simple: when people have no money in their pockets, they can hardly invest an entrepreneur in whatever ways. And when people are no longer able to produce a commodity, the wealth that the elites have exploited goes nowhere because there's nothing to buy. Civil protest is usually a risk signal, and also a buffer against the ultimate void.

But from my view, there is a thing that is more risky in the capitalist system nowadays: Gambling. Gambling here does not refer to what people do in the casino, but a behavioral pattern resembling the gamblers. In next chapter I will explain how the market and media foster "gambling" scenes in our daily lives, which evolves into the most unwanted result that a society should prevent its people from.

Written in Jan 18, 2025.

喜欢我的作品吗?别忘了给予支持与赞赏,让我知道在创作的路上有你陪伴,一起延续这份热忱!

- 来自作者

- 相关推荐